Successfully Navigating a Multi-Orbit World

In a rapidly changing industry, multi-orbit satellite connectivity has taken centre stage

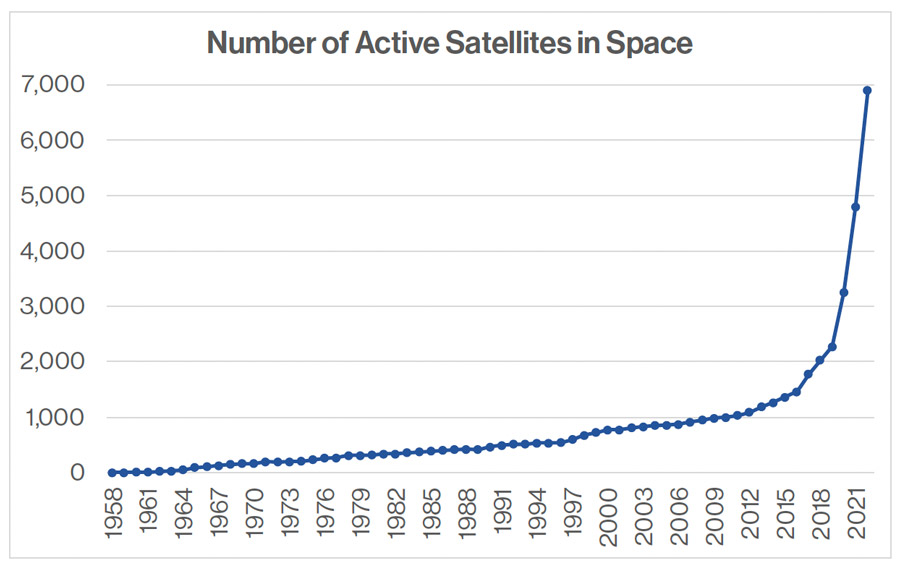

In 1962, NASA launched the world’s first communication satellite, Telstar, and the space communications industry was born. It took 50 years to reach the milestone of having 1,000 active satellites in orbit. Since then, the “new space” explosion has accelerated at an incredible rate. In the last ten years, from 2012 to 2022, a further 6,000 satellites have entered service and major launches have been occurring monthly in 2023.

Source: Statista

Until recently, the majority of communications satellites were geostationary (GEO) – orbiting the world at an identical rate to planet Earth and therefore appearing to sit in a stationary position in the sky. The emergence of non-geostationary orbit (NGSO) satellites, encompassing MEO (middle Earth orbit) and LEO (low Earth orbit), has been a key contributor to a rise in the number of satellites.

|

GEO |

MEO |

LEO |

|

|

Orbit |

36,000 km |

5,000 – 10,000 km |

500 – 1,200 km |

|

Satellites required 1 |

3 |

6-20 |

Hundreds |

|

Antenna speed |

Stationary |

1-hour slow tracking |

10-minute fast tracking |

|

Capacity per satellite |

Up to 1 Tbps |

~100 Gbps |

5-20 Gbps |

|

Latency |

>500 ms |

100-200ms |

25-100ms |

|

Typical satellite life |

15 years |

5-8 years |

5 years |

LEO constellations have driven this growth, with the Space X Starlink constellation leading the pack. In October 2023, Starlink reached the milestone of having 5,000 active satellites which is well over half the active satellites in space. OneWeb, Telesat and Amazon (Project Kuiper) are also planning and building large LEO constellations. NSR analysis concluded that NGSO satellites already constituted the majority of HTS (high throughput satellite) capacity operational in space by the end of 20222.

1 to cover Earth population | 2 NSR Global Satellite Capacity Supply and Demand report (20th edition, 2023)

In the “new space” landscape, GEO incumbents have evolved

Before the advent of “new space”, the satellite communications industry was dominated by seven global players – Echostar/Hughes, Eutelsat, Intelsat, SES, Telesat, Viasat and Inmarsat. This has become six, following Viasat’s recent acquisition of Inmarsat. These companies predominantly operated GEO satellites, while new entrants focussed on opportunities in MEO and LEO.

This has rapidly and radically shifted and the majority of these global plays have now adopted a multi-orbit strategy by acquiring or building NGSO capacity. The rate of announcements and developments has been breathtaking.

|

Operator |

Muti-Orbit Strategy Announcement |

Date |

|

Eutelsat |

Announced completion of acquisition of OneWeb LEO business for c. US$3bn |

September 2023 |

|

Intelsat |

Announced potential plan to build 18 satellite MEO constellation |

September 2023 |

|

SES |

Lauch of mPOWER 3 & 4 – part of planned 11 satellite MEO constellation |

April 2023 |

|

Telesat |

Announced completion of funding for Lightspeed LEO constellation and placed launch contracts with Space X |

August and September 2023 |

|

Viasat |

Announcement of proliferated LEO (PLEO) contract with US Department of Defence |

September 2023 |

How Avanti predicts these changes will impact strategy, competition, and customer choice

With the shift in industry structure and complexity, Avanti has identified three key themes that will impact strategy, competition and customer choice:

- As connectivity technologies develop and evolve, there is a strong convergence between terrestrial and non-terrestrial connectivity. Increasingly, the space industry should be seen as a segment of the global telecommunications industry rather than as a separate domain.

- The growing number of orbits and connectivity options, while having the potential to deliver more choices and flexibility, risks confusing the customer and slowing down project delivery.

- Capacity will be increasingly commoditised (NSR forecast that HTS fill rates will remain below 10% over the next 10 years), and as we see elsewhere in the telecoms industry, value will inexorably move down the chain from raw connectivity to services and solutions.

The Avanti response: Our customer-centric multi-orbit strategy

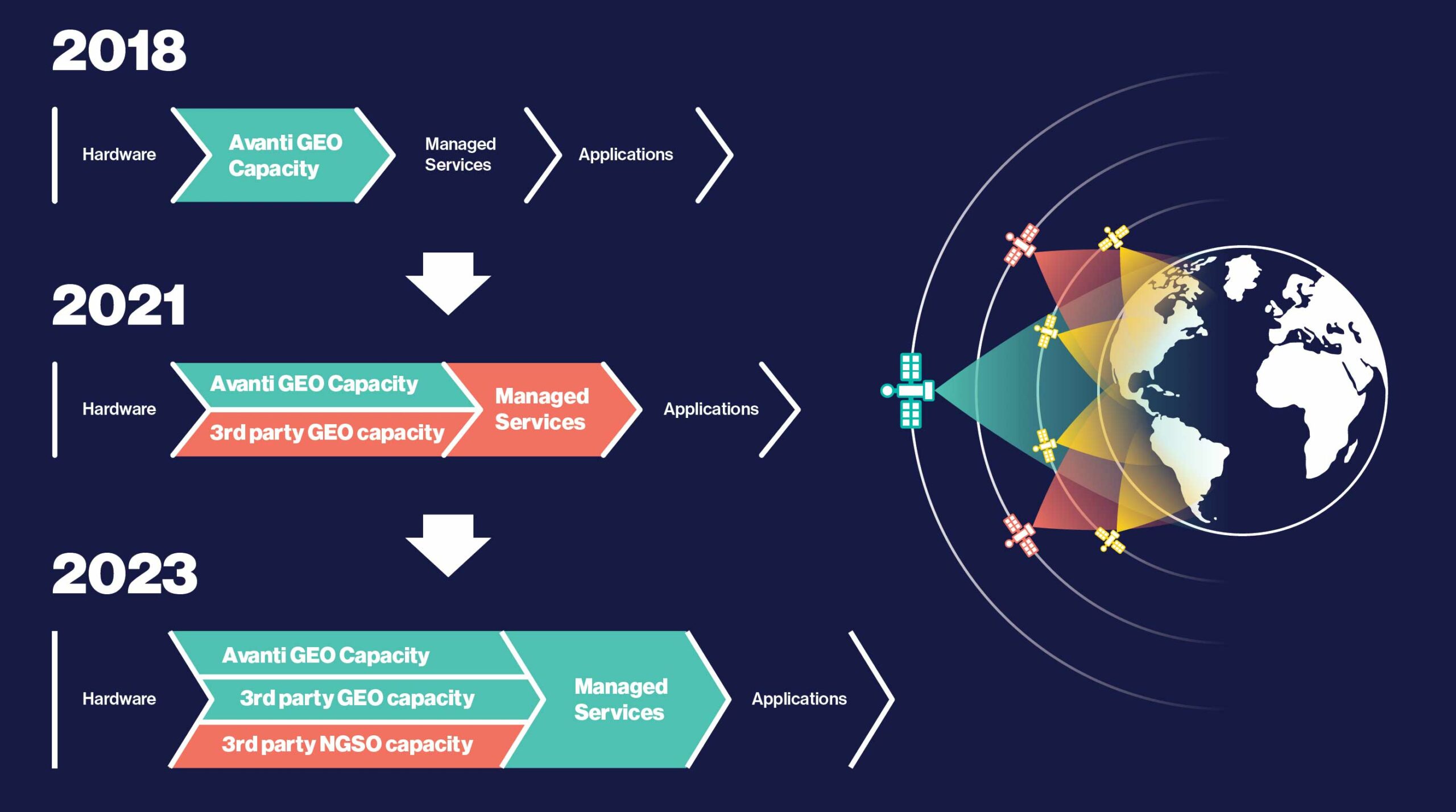

At Avanti, we implemented the first phase of our customer-centric strategy in 2018, which has delivered 270% growth in bandwidth revenues since then. Our customers span many industries including defence, aero, maritime, enterprise, rural communities and schools, satellite operators and governments. Each has specific, but diverse requirements, and those requirements are evolving.

As a result, our customer-centric multi-orbit strategy will have three key elements:

- Avanti has already transformed into a customer-led business and will now embark on the next phase of its journey to meet customers’ requirements with multi-orbit solutions tailored to their needs on a global basis. The “customer-pull” vs. “technology-push” model will help cut through the “technology hype” to identify the best and most effective solutions.

- Avanti is partnering with other GEO, LEO & MEO operators to procure capacity to deliver what works for our customers, rather than investing in building and extending coverage and capacity.

- Avanti will also invest in managed service capabilities to deliver tailored solutions to meet the needs of our customers anywhere in the world.